This post has already been read 4083 times!

Whole Foods stock surges 28% on Amazon acquisition news, will retailers retreat or rebel?

If grocery companies weren’t shaken enough by discount chains Aldi and the impending arrival of Lidl in the U.S., they are now. Amazon plans to buy Whole Foods in $13.7 billion deal later this year.

Darren Tristano, chief insights officer at Technomic told CNBC that he thinks this is a good move for Amazon:

“The brand is a good compliment to Amazon and would allow them to more aggressively target fresh food delivery to the at-home market.”

The news of Amazon’s acquisition has shaken the grocery stocks. Kroger plummeted 16%, Supervalu 11.5% and Costco 6.5%.

The obvious question is what will Amazon do to grocery with it’s discount might, online presence and huge customer base?

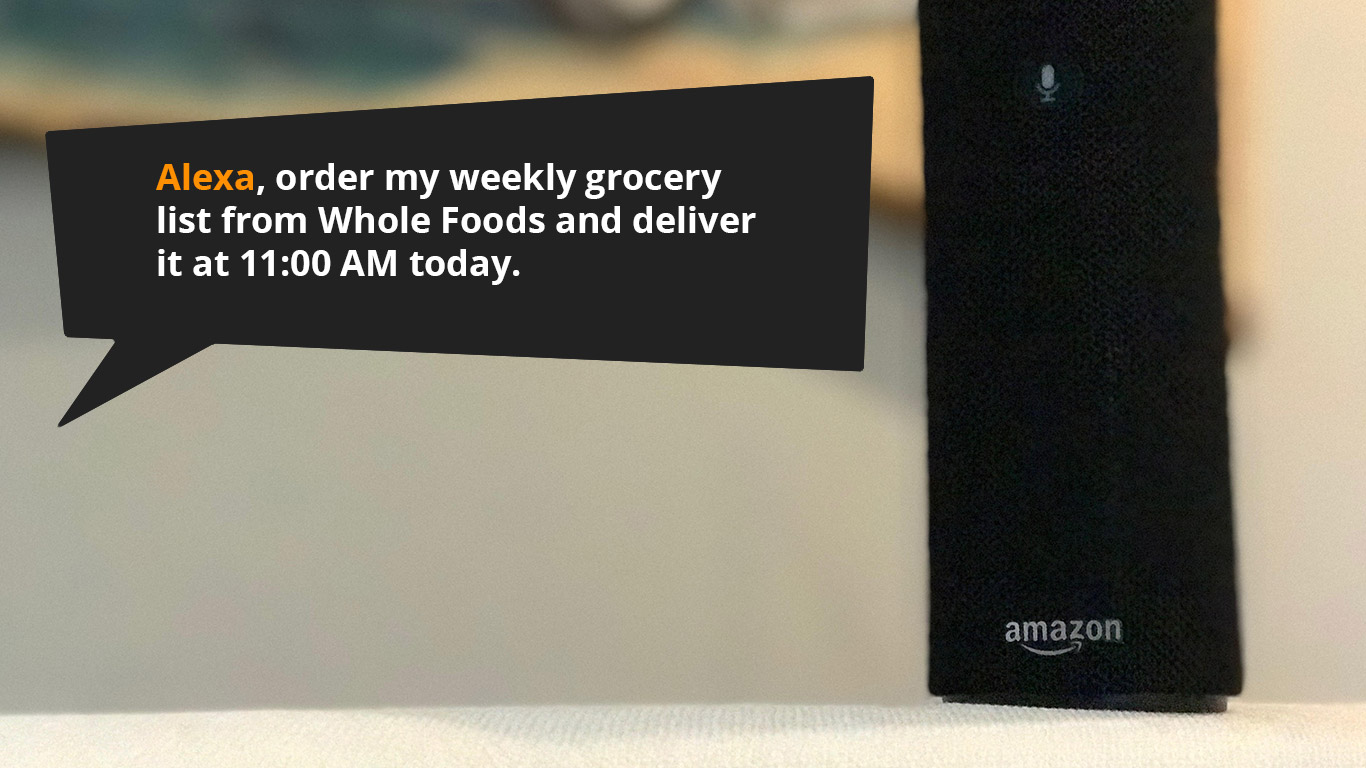

On the other side, Amazon gains a massive brick-and-mortar presence and a distribution network. This means it could theoretically push all kinds of product through the network to consumers. Forget next-day or even same-day delivery… how about same-hour delivery and pick-up? And with Alexa, there’s no need to interrupt your movie, just tell Alexa to send that six pack and pizza pronto.

What this means is that It’s more urgent now than ever, that retailers unify with their trading partners to compete with Amazon. In a recent article, Greg Brady discusses the critical role of digital networks and how companies can level the playing field:

Disrupting E-commerce: How Digital Networks Are Creating an Excellent Customer Experience

Bernard Goor has just written a piece that explains how digital networks can help grocers compete against Amazon.

- How to Avoid a Technology Horror Story - October 31, 2024

- How Chain of Custody Strengthens the Supply Chain - October 11, 2022

- Inside Next Generation Supply Chains - November 8, 2021