This post has already been read 14942 times!

How CFOs are leveraging Intelligent Control Towers to align financial and supply chain decision-making for better results.

Today’s modern organization has critical links that comprise a complex ecosystem. It’s made up of customers, partners, employees, connected factories, vehicles and devices. In fact, most of the value and data a company needs to function effectively lies outside its four walls.

This expansion in scope impacts every aspect of the business and as a result, the traditional, centralized enterprise decision-making paradigm is losing hold, especially for CFOs. Successful companies today take a horizontal approach that breaks down traditional silos, streamlines processes, and enables efficient, customer-driven collaboration across the entire system.

In this environment, the role of the CFO has broadened and changed. While data from connections in the extended enterprise may be readily available, using it to free up capital, make smart investment decisions, and improve the accuracy of budget and cash flow forecasts remains challenging.

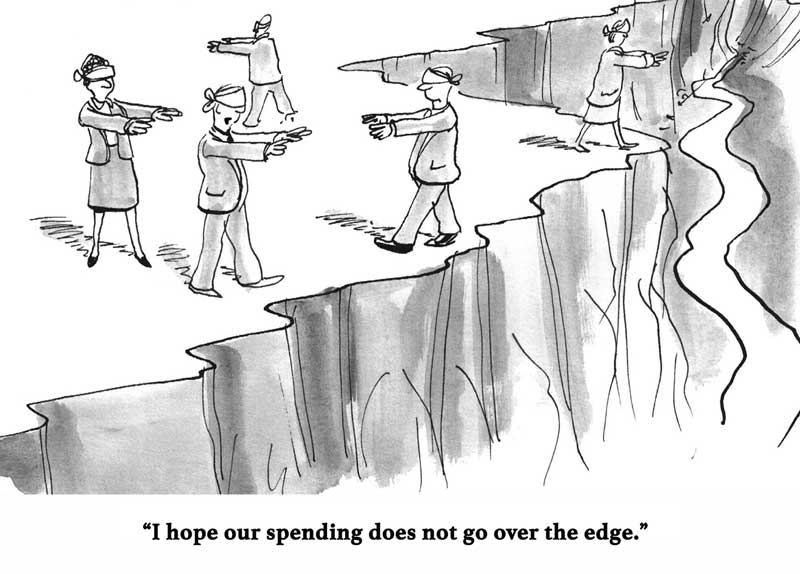

This is because finance leaders require more detailed visibility into the supply chain much earlier, as increasing volatility in supply chain markets affects overall financial and market performance. In addition, brands face increased media scrutiny and regulatory criteria as supply chains become global and consumers more informed. CFOs must balance conflicting demands as they make reinvestment decisions that facilitate ethical, sustainable growth while maintaining a disciplined drive for operational efficiency and shareholder value.

Why ERP Systems Can’t Keep Pace with Today’s Complex, Connected Ecosystem

Many finance leaders have turned to enterprise resource planning (ERP) systems, to improve visibility into the supply chain only to find that the information provided was limited to within the four walls of the enterprise. While ERP solutions are able to produce reports for business unit leaders that include extended guess-work in forecasts and planning, the reality is that the information generated is almost always outdated before anyone can read it.

These systems and processes lack real-time visibility into the supply chain and the kind of fresh, verifiable data that a CFO needs to maintain a tight grip on costs and working capital. Centered as they are on the enterprise, ERP systems fail to furnish the comprehensive and accurate views into the supply chain and the extended business because they neglect to take in all the factors that occur outside of your company.

How Intelligent Control Towers are Powering the Modern Business

Like your favorite social media platform, intelligent control towers are enabling a true digital commerce network that naturally and natively syncs all departments and trading partners to a real-time, single version of the truth. Unlike insular ERP systems, these control towers support the multiple end-to-end business flows that take place across the entire supply chain at every stage of the value chain, without limitation.

A network-based Control Tower for CFOs means they can isolate cash flow in real time, along with inventory levels and turnover, and see the effects on working capital and related costs. - says Paul Waggoner @onenetwork Share on XBecause it stands on a network, with access to data from all companies in the extended supply chain, intelligent control towers deliver a timely, accurate and complete view of the enterprise supply chain. With this singular view, CFOs can isolate cash flow in real time, along with inventory levels and turnover, and see how that affects working capital and related costs. They can compare current data to prior annual data, to capture improvements over time. These contemporary networks also allow both internal and external business leaders to work together seamlessly and orchestrate continuously optimized planning decisions across the extended enterprise as business activities transpire. Control tower networks help CFOs achieve significant improvement gains which include:

- Performing intelligent risk management: By combining network visibility, smart technology, and consistent, comprehensive data, control towers allow finance departments and supply chain managers to work together to understand where pockets of risk reside. By clearly depicting where fluctuating demand or volatile raw material prices affect the business, business leaders can manage and respond quickly and intelligently to changing market conditions and climates.

- Achieving a lean supply chain and reducing working capital requirements: Financial planners in retail distribution and manufacturing have a large portion of their capital tied up in inventory. With clear view of the entire supply chain, they can free up capital when inventory builds up or when sales fall below anticipated projections.

- Identifying investment strategies: Control towers deliver real-time operational data and clear insight into the supply chain. Armed with that information, the CFO can more easily understand where to direct the company’s investment strategy and how to optimize it to free up working capital.

- Producing broad, accurate views of the enterprise: Finance leaders are charged with aligning measurement tools and KPIs with company direction, to make sure they drive appropriate behaviors throughout the organization. That task is made much more effective when the CFO has clear insight into the complex workings of the extended enterprise.

- Generating a unified organization: Just like control towers connect external trading partners to align them toward a unified goal, these networks can also help connect and align divisions within the enterprise itself. In this way, the entire business can work together to grow revenue, improve margins, address risk, and deliver exceptional customer service.

- Attaining cost and resource advantages: Gaining insight into supply chain issues and operational efficiency allows CFOs to create more shareholder value by identifying opportunities for cost reduction, and prioritizing them, to reduce overall operating costs. Unlike traditional ERP solutions that require extended implementation timelines and significant IT resources, cloud-based control towers offer fast implementation, ongoing upgrades and support, and often greater value for the investment.

Generating Immediate Value Through Real-Time Visibility

Not only do intelligent control towers enable the business to deliver dramatic improvements in customer service levels, they can also reduce operating costs. For example, using a permissions framework, intelligent autonomous agents can optimize and execute processes and self-correct to continuously match supply to demand independent of human involvement. The control tower can also embrace legacy systems to get the most from existing IT investments, while empowering the enterprise with powerful new technologies like machine learning and blockchain.

In today’s data-driven world, the company leaders who can see, understand, and respond to constantly changing market conditions quickly and effectively, win. The question is, are you ready to start winning?

If you enjoyed this article, I recommend you download the brief report on this topic: A Control Tower for Chief Financial Officers

- Optimizing the Modern Enterprise with a Control Tower for CFOs - February 4, 2019