This post has already been read 15081 times!

How your supply chain impacts your profit and loss statement

In my recent webinar on Control Towers for Inbound Raw Materials, we discussed about how in the last 12-14 months, the world has really been focused on supply chains; and that the COVID-19 pandemic really exposed big gaps in in the supply chains that we run today, gaps in terms of the data, gaps in terms of processes and the systems that are in place. I also talked about resiliency and agility. Everyone’s talking about the importance of resiliency and agility and today’s supply chains because of the high level of variability. I also discussed how you can create a more resilient and agile supply chain through demand driven supply networks.

Recently, we’re seeing the chip shortages that affected automotive manufacturers in North America in particular, and impacting automotive manufacturers’ ability to actually produce cars to sell into the market.

I also talked about demand side problems. McKinsey did a survey on why people switch brands during COVID-19. And what was interesting from that was 65% of people switched brand, because the brand that they usually buy was not available showing you that when you’re not able to get the product to the market, people really are shifting brand. Sadly, they’re not going and looking for your brand elsewhere. They’re buying what they can buy.

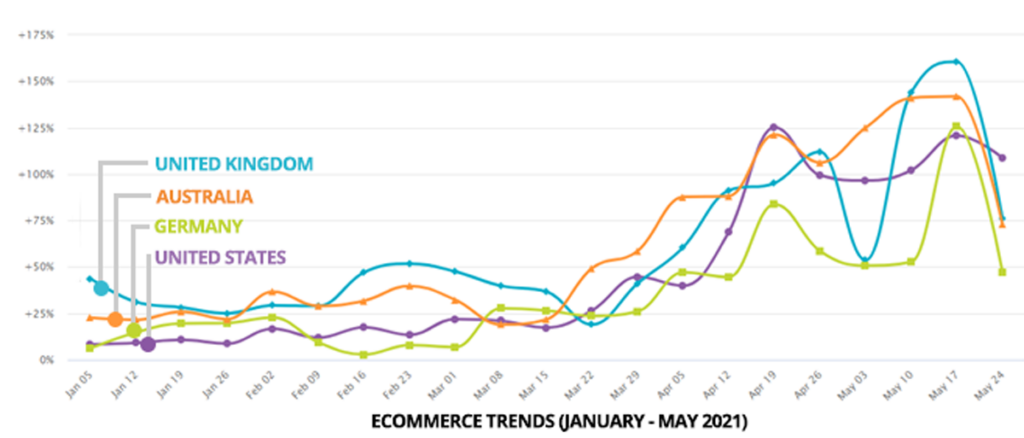

Where did supply chains face their biggest challenge in the last year? We asked over 200 supply chain professionals and the answer was surprising… #SupplyChain #Disruption Share on XDuring that webinar, we asked the audience what was the biggest challenge they were facing in their supply chain in the last year. And interestingly, as many people said unpredictable demand was their biggest challenge, as said supply issues or supply shortages and supply production capacity. So the major challenge is split equally between the demand side and the supply side. I was quite surprised. I really expected that the main issue would be with supply. But when you look at what is actually happening within ecommerce, it is understandable.

So this is data from this year from January-May 2021 for the United States, United Kingdom, Germany and Australia. And you can see that that ecommerce demand has increased or the revenue generated from ecommerce has generally increased by 125%, in the first five months of year, this year. The other interesting thing though, there is the variability in April and May. So when these countries were coming out of lockdown, that variability increased even more. So yeah, so it’s not surprising that in a webinar about inbound supply aimed at manufacturers, half of the respondents or 40% of the respondents said that the biggest challenge they’re having right now is with unpredictable demand. Because people are buying via ecommerce, and people’s purchasing habits have really changed drastically in the last year.

How does your supply chain impact your your profit and loss statement? Shirell James explains the financial effects of supply chain management… #SupplyChain #Financials Share on XIn this article, I’m going to focus on demand. We will look at what impact demand variability has on your key supply chain metrics, and on your Annual Report, I’m going to look at why today supply chains are not able to effectively respond to variability, and therefore why they struggle to improve key supply chain metrics. And then we’re going to look at the value of multiparty networks, and how you can maximize customer service levels across the supply chain without increasing inventory, and therefore positively impact your profit and loss statement (P&L).

The Impact of Your Supply Chain on Your Annual Report

As we know, the annual report is the income statement, the balance sheet and the cash flow statement. Supply chains have a direct impact on the annual report, positively or negative.

For example, whether your product is available to the consumer, enabling you to maximize your sales, increase your revenue, capture market share.

Reducing your cost of goods sold across the entire supply chain, can have a significant effect on margins and profitability.

Turning your products quickly, enables you to improve your cash flow and optimize your working capital and improving your cash flow.

But we can we’ve seen in the past how supply chains can be actually really damaging for the annual report. Take Cisco in the early 2000s, where they didn’t have good visibility into demand or supply, and consequently, didn’t see the tech bubble bursting. They didn’t see that coming and they ended up with huge amounts of inventory, and they ended up writing off $2.2 billion in inventory off their books and their stock price dropped 50% and it took them a long time to recover.

Apple in the 90s they took on the opposite direction and had a very conservative inventory approach. They didn’t have enough inventory to meet the demand for power Macs and they lost market share, and they never really recovered it until they came up with the iPod and the iPhone and we’re able to get people back to Apple.

So there’s long term damage that is done to the annual report and stock value and market share when the supply chain is not working effectively.

I think we’re in an environment where it right now where that risk is very high, there’s so much uncertainty and there’s so much variability, the rest of the supply chain is very high right at risk of the annual report is very high. So I want to focus on four metrics that impact the P&L.

On-Time In-Full. So these are metrics that we talk a lot about when we’re talking to particularly manufacturers, so on time in full, so one time in full is the time for out to your customer, but on time and for also in from your supply. But when we talk to manufacturers at the moment, and ask them why they’re doing particular projects, typically the answer is I need to improve on-time and in-full to my customers. And what we’re seeing is that on time, and full is generally dropping, and it’s dropping because of demand variability, and it’s dropping because of product availability. So if you can’t get the supply, you don’t have the products in the right place, you’re not able to to meet your on time and full targets.

Operating Costs. Operating cost is increasing. We’re seeing a much more firefighting, problem solving, and on-time and in-full penalties. It’s all leading to an increase in the operating cost.

Expedited Freight. We hear of companies that are expediting product to get to the market in time for promotions or expediting raw materials into their production facilities, so they don’t need to shut down production. There’s a huge amount of expedite freight occurring.

Inventory. Many companies are holding higher safety stocks, but they’re also holding the wrong safety stocks. We see companies struggling because they don’t know what’s happening with demand, or where that demand is. So where do they place their inventory? That’s a crucial question, if you want to make sure you’re able to meet the demand. This combination of higher safety stocks to buffer against uncertainty, and misplaced inventory, all that obviously impacts the P&L.

And so if you can’t get your product to your consumer, your revenue is going to drop. If your operating costs and freight costs are higher, your expenses are going up. If you’re holding more inventory, or your inventory is in the wrong place, your working capital is going up, or it’s not working effectively for you, your cash flow is dropping, because you’re not able to turn the product. So your overall cost of goods sold is increasing within the P&L.

Inventory vs Service

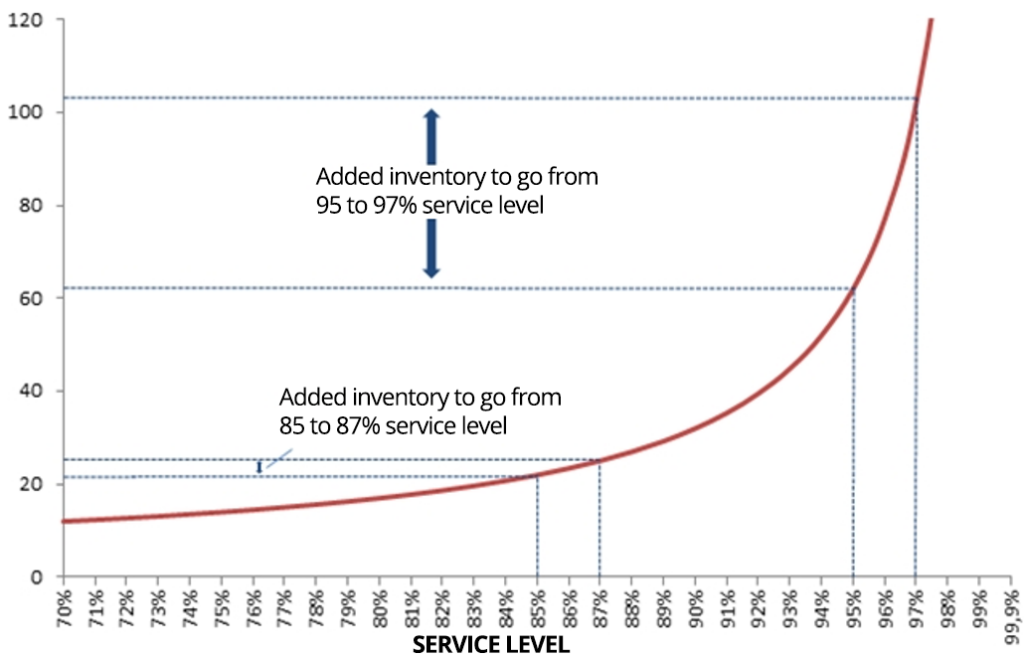

We all understand the inventory versus service challenge, and this graph is probably very familiar to you.

The higher the service level, the more inventory you need to hold, and the higher you try to push your service level up, the inventory required to support it grows exponentially.

So to increase your service level from 85% to 87% there is not a significant increase in inventory. But when you try to increase in the upper ranges, say from 95% to 97%, the amount of inventory required is very significant.

One of the goals and challenges of supply chain is to balance that cost of stock-outs and the cost of inventory. The Cisco and Apple examples show how two different strategies can go very badly wrong. Apple was very conservative, suffered lots of stock outs, and lost market share,

Cisco, was more aggressive and held a lot of inventory and a big investment tied up in those inventory stocks. Then they were forced to write-off that $2.2 billion.

Inventory Optimization & ABC Analysis

So what companies have done for the last maybe 15-20 years is really focus on things like inventory optimization. How do I make sure I have the right inventory in the right place, the right safety stocks, based on demand variability, supply variability, lead time variability, service levels, etc. They’ve also tried to improve their forecast with more sophisticated statistical forecasting, to try and preempt that demand variability. With a better prediction of demand they have been dampen some of that demand variability. They’ve also used ABC analysis to categorize products and parts and have different stocking strategies, different replenishment strategies for those items.

But the questions is: do these techniques still work in today’s world?

Say you’re looking to optimize your inventory, which is looking at demand and supply variability. If that demand variability and supply variability is changing weekly, how can you run inventory optimization, when everything anything you knew before, on which your statistical forecasting is based, has changed? How can statistical forecasting help you?

I would say that’s not much use.

Those techniques, while they add value within the enterprise, cannot really help optimize the P&L in today’s world.

The reason is that end-to-end supply chains, not just the supply chain that’s in your realm of control, is sub-optimal.

There are around 21 optimizations occurring in the typical end-to-end supply chain. So for the product to be sold to the consumer, there’s all these optimization steps that occur along the way for the products to get through the supply chain for it to be manufactured and shipped to the customer. Everyone is doing their own optimizing at each of the tiers. But what they’re doing is optimizing on stale data.

If you’re a manufacturer, you don’t typically have the latest demand information, you don’t have the, say the latest supply information of your tier and suppliers. And it’s even worse for those tier end suppliers, who are much further away from the demand signal. It takes a long time for suppliers to see the impact of demand variability. And it takes a long time for manufacturers to see the impact of supply variability.

Another issue here is lead time. So you have both informational, and physical lead times. Informational lead times is the time it takes for this information to move between all the tiers. Several years ago, Gartner put out a report that said that 40% of actual lead time is really informational lead time. This is a significant factor that impacts everything from optimization, decision making and physical lead times.

So you can imagine that if you’re able to get rid of that information on lead time, what impact that is going to have on the supply chain. It’s going to make it more agile and more resilient, because everything’s able to, to move quicker.

So the second problem in supply chains today is that lead time. And in connection with this there is the problem of “fake” lead times. These are common in transportation.

Say for example, I’ve got an ocean vessel moving and it takes six weeks to go from A to B. But in actual fact, it doesn’t take six weeks, sometimes it could take four weeks, sometimes it could take eight weeks. But these fake lead times are put into the planning process at each tier to try and get a plan to work.

So overall, if you look at that entire network, there you have a lot of fake lead time padding, in addition to informational lead times, all adding to lead time overall.

Then you’ve got a lot of local optimization going on, within each node and tier, when you don’t really know what the end demand really is, or what the demand and supply variability is. And so you’ve got lots of buffer inventory throughout that entire supply chain.

So what does this mean?

It means we have all that data trapped at every node, everyone is buffering inventory. All these different supply chain partners are not able to see the actual end demand. The service levels are dropping. Everyone is optimizing those metrics individually, without really knowing what’s going on outside their domain. You have informational lead times, fake lead times, lots of variability in the system.

So the techniques that we used in the past to try and deal with variability are not working. In our discussions with manufacturers, the thing we hear is, “I have a big problem with OTIF, I really need to improve OTIF. But I don’t want to do that and the cost of increasing inventory, because already I’ve got an inventory problem, I’ve got inventory in the wrong place. And, you know, I need to find a way to improve that OTIF without impacting inventory.” That’s one big opportunity. How you can maximize your service levels, and therefore revenue, without increasing inventory, and therefore capital and costs. This is the holy grail of the supply chain. How can you do this? I’ll explain in my next post.

You might also like…

Recommended Posts

- Are Micro Fulfillment Centers the Next Frontier in Retail Logistics?

- Rethinking Defense Supply Chains with Network-Based Command Centers

- How to Use Predictive Analytics to Streamline Cross-Border Logistics

- AI Plus Humans for Resilient Freight Forwarding in a Complex World

- Modern Defense Supply Chains: The Essential Capabilities for Multi-Domain Operations

- How to Optimize Your P&L with Your Supply Chain (Part 2) - September 15, 2021

- How to Optimize Your Profit and Loss with a Demand Driven Supply Network - July 22, 2021