This post has already been read 19632 times!

Today and in the posts that follow, I want to discuss the technology transformation that many supply chains are undergoing, and discuss how these changes can help the wider organization move from “good” to “great”.

Enterprises today face a conundrum in the optimization of their supply network performance. While many have driven significant improvements over the past few years through the application of advanced tools, processes, analytics, and measurement systems, how can they ensure that they are progressing from ‘good’ to ‘great’ in their market opportunities, their customer service levels, and their financial performance?

Key elements that must be brought together as part of this holistic approach are overall network assets, demand and supply information, market demographics, financial data, trading contracts, material sourcing, commodity pricing, and any relevant standards bodies, statutory, or regulatory requirements.

Many organizations have participated in worthwhile measurement initiatives such as SCOR or the Balanced Scorecard. Yet despite these advances it is still difficult to normalize and compare performance metrics given the geo-demographic, product, financial, political, and socio-economic differences they face in each increasingly competitive national, multi-national or global market.

As today’s practitioners know, supply networks appear to be straightforward on the surface, using normalizations such as SCOR’s Plan, Source, Make, Deliver and Return. But upon deeper examination many components require real time integration, coordination, and collaboration in order to deliver on a higher level of performance.

And although analyst reports try to categorize, rank, or slot solution capabilities, these measurement methods typically suffer from the subjectivity related to how the measurements were derived, interpreted, researched, and eventually applied to the ranked entities.

Key elements that must be brought together as part of this holistic approach are overall network assets, demand and supply information, market demographics, financial data, trading contracts, material sourcing, commodity pricing, and any relevant standards bodies, statutory, or regulatory requirements.

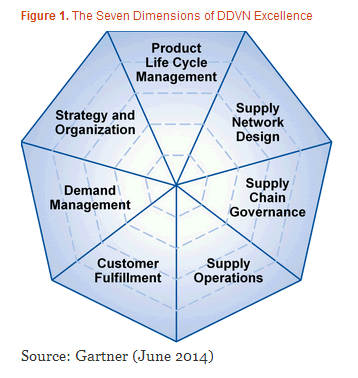

Something similar to this holistic approach is Gartner Research’s “Seven Dimensions of Demand-Driven Value Network Excellence”:

Integrating these elements into one seamless flow is many times looked upon as a technology problem, and while technology plays a key role in creating effective supply network operations, it is often the non-technology components such as organizational structure, performance measurement, and the resulting employee culture that truly separate great performance from marginal performance.

Enterprises also need the ability to segment these networks when running their longer term IBP processes. Different strategies should be used for various geographies, channels, product types, manufacturing methods, product life cycle, tax scenarios, logistics options, customs implications etc. The goal is for the various dimensions of process, metrics and technology to operate with increasing levels of maturity until the enterprise can achieve full multi-party, multi-echelon collaboration across trading partners. This includes scenario-based profitability planning and execution across multiple variables utilizing process automation and advanced analytics to drive desired outcomes.

The challenge is twofold. The organization must operate on these network elements in both the short term or real time execution environment, as well as the longer term integrated business planning environment. The need for a single version of the truth driven from a statistical sales forecast remains the same for both short term and long term optimization. A platform which enables this single version of the truth across both the real times execution environment and the longer term IBP environment is the key enabler.

To read more about this subject, I suggest you read the new whitepaper, Supply Chain’s New World Order”.

- Generative AI: Force Multiplier for Autonomous Supply Chain Management - May 23, 2024

- Top 5 Signs Your Supply Chain is Dysfunctional - August 19, 2022

- Why a Network Model Makes Sense for Automotive Suppliers - July 30, 2019