This post has already been read 17286 times!

In this two-part article we will look at the major challenges faced by pharmaceutical brands and the new network thinking that can solve them.

Pharma brands are currently navigating a challenging time in terms of managing their product portfolio and countering the threats from generic brands as late cycle molecules near the patent cliff and rampant product substitution starts taking place. The product portfolios in large Brand Pharma companies also vary, and that creates a compounding stress impact on their supply chains, and the challenge of creating and sustaining a scalable supply chain operating model.

Although Pharma supply chains are typically global in nature (40 percent of Pharma products are traded locally/in-region as opposed to 50 percent in other sectors) there are critical ingredients, raw materials that are sourced locally that make some parts of the supply chain vulnerable to regional risks.

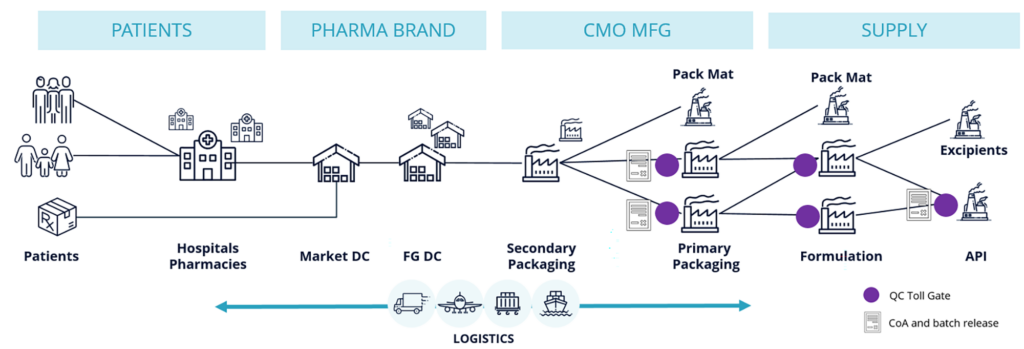

Pharma companies have also outsourced their production to a great extent to Contract Manufacturing Firms (CDMO) than other sectors (more than 60% of Pharma manufacturing is currently outsourced). This exacerbates the need for greater visibility and collaboration with CDMOs and upstream (Tier 2+) suppliers in order to respond to changing supply and demand shocks, and to make continuous adjustments.

How pharmaceutical brands can use supply chain as a competitive advantage against generics… Share on XTypically, Brand Pharma companies classify their product portfolio into three groups:

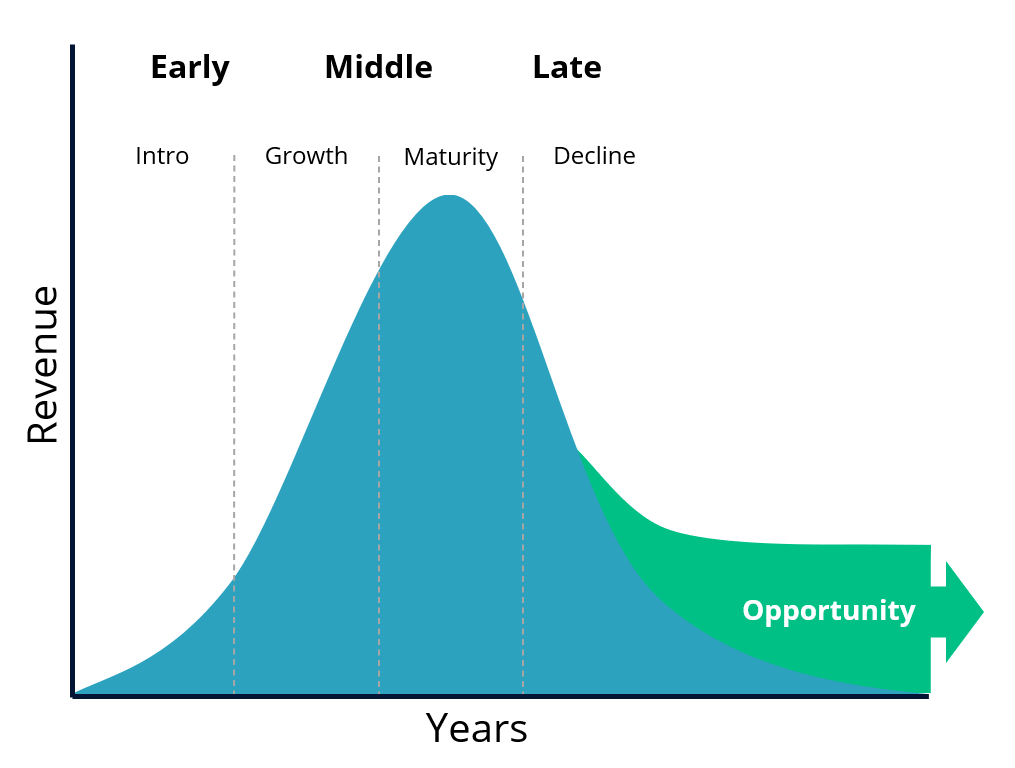

- Early Life Cycle Products – Research and development stage: from the drug discovery up to its launch to the market. Focus on this stage is more on commercial innovation and less on operational excellence.

- Mid Life Cycle products – The middle stage: the period between its launch and the loss of market exclusivity. This is a phase of growth and supply issues could cause serious impact on market reach and penetration.

- Late Life Cycle Products – The late stage: the period after the loss of market exclusivity (when generics can enter the market). Operational excellence assumes critical importance as there is increasing margin pressure and push to reduce operating costs.

How Do Supply Chain Strategies Shift Across the Lifecycle of a Product?

- Early Lifecycle – The key focus areas for products at this stage is speed to market. There are usually complex supply chain processes which lack scale, and there are multiple partners in the Sourcing, Manufacturing, and Distribution Mix. Visibility and transparency across partners become key. Quality and batch release procedures play a big role in determining supply chain risk and resilience.

- Mid to Late cycle – When the formulation stabilizes, Brands look at multi-supplier sources and manufacturing/distribution attains scale and operational efficiency. Lead times become an important attribute to measure and optimize and demand and supply shocks have a substantial impact on product profitability and market share.

The Network Paradigm for Pharmaceutical Supply Chains

The supply chain of the future is no longer a chain.

When we stop thinking of managing pharmaceutical supply chains as static, batch-processed, and serial links, new possibilities emerge, that dramatically improve how pharmaceutical supply chain function.

In a network, all parties (pharma brands, CDMOs, API, packagers, carriers, etc.) are hubs, as opposed to spokes serving a customer, and all nodes are connected to a real-time, single version of the truth. (A robust permissibility framework ensures each party only sees the data they have been given permission to see by the owner.)

In a nutshell, the modernized value chain network enables optimization across every decision point, from research and development through manufacturing and distribution to consumers.

And this is the key that unlocks the hidden opportunity in the late stage of the product lifecycle (as well as many others).

To maximize agility, optimization and resilience, we need to orchestrate processes across the entire supply network, not merely within an enterprise or node. This means orchestrating across customers to suppliers, from internal plants and contract manufacturers to distributors and logistics providers around the globe.

It’s a network problem, one that requires real-time information and a single version of the truth for all parties. We can’t solve a network problem with enterprise-centric thinking. We need a true network, and a supply chain control tower purpose-built for networks.

A network perspective combined with a true digital supply chain network unlocks immense value in the supply chain, giving pharmaceutical companies a significant competitive advantage across product lifecycle stages.

What pharmaceutical brands need is a competitive advantage that extends beyond patents and provides value before, during, and after patent expiration… Share on XWant to know more?

In part 2, 7 Supply Chain Strategies for Pharma Brands, I apply this way of thinking to see how a digital supply chain network can be used by Pharmaceutical Brands to counteract the competition from generics.

Even better, Joe Bellini and I did a webinar on this topic, How Pharma Brands Can Win Against Generics. Joe and I go into more detail, explain the 9 strategies pharma brands can use, and answered the most common question we get on this.

- The 4 Top Challenges in Deploying AI in Healthcare and Pharmaceutical Supply Chains - January 7, 2024

- How to Achieve Patient-Centric Supply Chains - October 20, 2023

- How to Achieve N-Tier Orchestration in Upstream Pharmaceutical Supply Chains - October 3, 2023